While our on boarding and transitions team is hard at work transferring over your clients for 60 days post join day, we have compiled a landing page of resources to ensure continuity

Please contact Kate Quinn – Manager, Advisor Growth Strategies, with any questions.

Compliance

Business Continuity Plan (for branch managers only)

The Business Continuity Plan is required for every branch. It is also required to be updated and tested every year and should be given to each new person who joins a branch. You will need to complete, sign & date, and email a copy to compliance@greatvalleyadvisors.com. The last pages of the BCP are the test pages, to be completed within 12 months and also sent to compliance@greatvalleyadvisors.com. Please CLICK HERE for ClientWorks training on BCP.

Branch Office Security Policy

Attached is the Branch Office Security Policy which includes guidelines on the emailing of confidential information. You are required to complete the New Hire Security and Privacy training module on LPL’s Learning Center prior to receiving full ClientWorks Access.

**This module was completed during the onboarding process**

Please familiarize yourself with the attached Branch Office Security Policy, which is also available on the ClientWorks Resource Center for future reference.

Social Media

Your social media training module was completed during the onboarding process; however, you must also enroll in Social Patrol, a tool that allows LPL to capture posts and automatically scan them for review by Marketing Regulatory Review (MRR).

However, you must also enroll in Social Patrol, a tool that allows LPL to automate by capturing posts and automatically scanning them for review by Marketing Regulatory Review. All Facebook, LinkedIn and Twitter accounts must be registered with Social Patrol before you can post content. The attached guide walks you through signing up via the Resource Center in ClientWorks.

Advertising Review Tool

All pieces of marketing content that contain your logo need to be reviewed and approved by LPL prior to use. LPL’s Advertising Review Tool (ART), a platform within ClientWorks, provides the ability to submit, track, review, and archive your retail and institutional communications and public appearances. This tool offers a paperless solution to meet your branch advertising file review requirements. CLICK HERE for details and training on ART.

Onboarding Documentation

Note: All new advisor documentation is proprietary and should not be shared externally.

How Does GVA Support New Advisors?

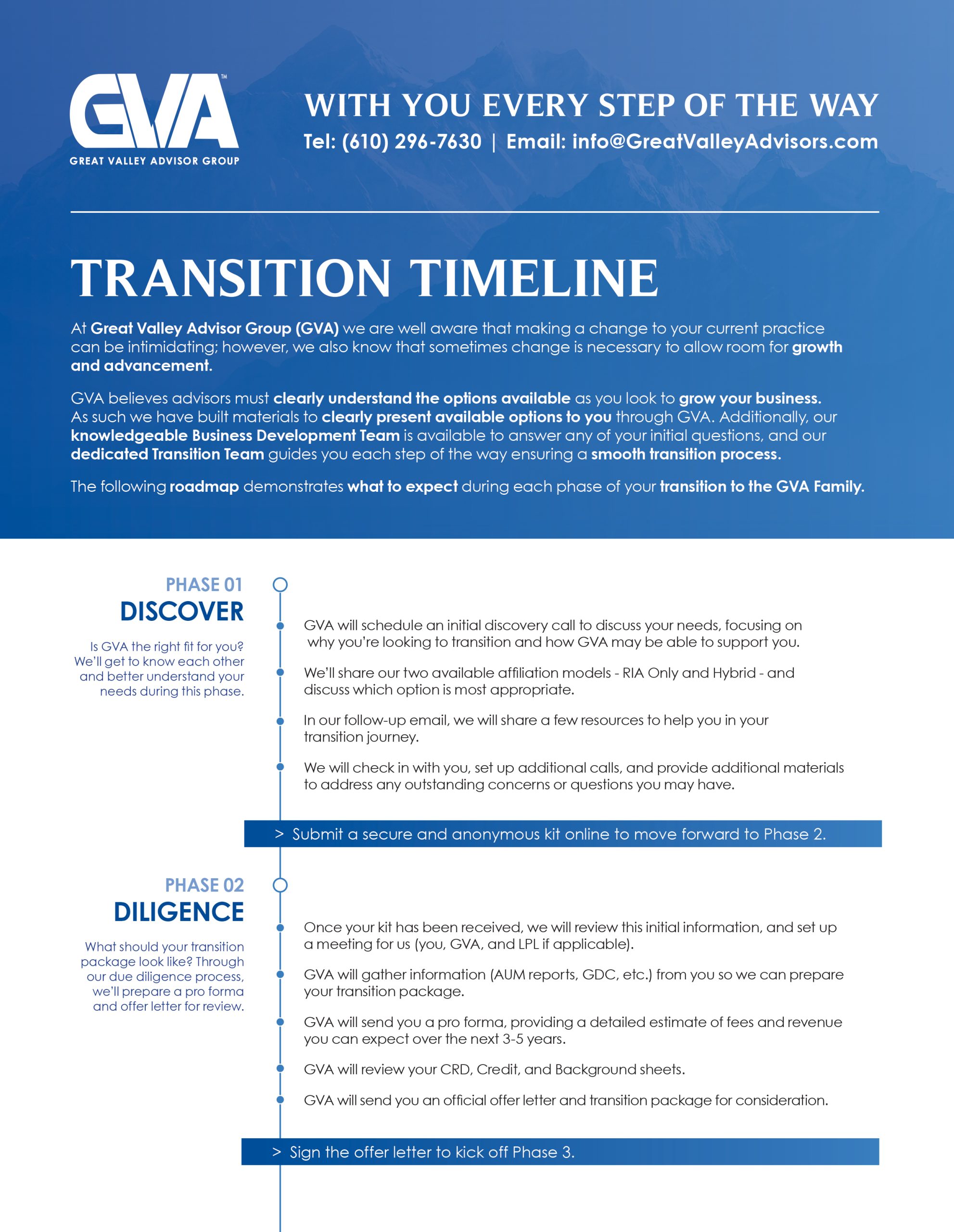

When Great Valley Advisor Group (GVA) was founded, it was built from the ground up with purpose. And at the forefront, the premise that collaboration drives success. As a GVA advisor you are part of a team, a family, and you are never alone.

GVA offers best-in-class solutions to support you through your transition to independence. Our dedicated Transition Team is focused on YOU, working effectively and efficiently to launch you on our platform as quickly and smoothly as possible.

The GVA Transition Team handles your change of custodian so you can continue to focus on your clients and growing your business. A typical transition takes 4-5 weeks; however, we understand that no two transitions are alike, and, as such we take a personalized approach to each.

Innovative Solutions

GVA Compliance does the

paperwork for you and ensures

you’re up-to-date on the latest

industry and compliance news.

GVA Asset Management manages

client asset allocation, integrates

industry-leading research, and

reports audited performance.

GVA provides options for advisors

to choose their desired exit

approach, all while supporting

the client relationship.

GVA Insurance Brokers offer

full-service security beyond

financial planning and

asset management.

GVA Technology suite provides

effortless integration and

support, tailored to your

business needs.

GVA Virtual Admin removes

the burden of everyday

tasks so you can focus on

clients and assets.